Press release -

Soaring motor premiums fuelling spike in uninsured younger drivers

PRESS RELEASE: 00:01, 17th May 2024

- Drivers aged 17-20 with new IN10 endorsements increases by almost over a quarter in just 12 months as premiums jump by 25% between 2022 to 2023*

- IAM RoadSmart launches new campaign to bring costs down

The number of young motorists aged 17-20 punished for driving without insurance has increased by more than a quarter (28%) between 2022 and 2023 and by almost 200% since 2021 according to new statistics analysed by the UK’s leading road safety charity IAM RoadSmart.

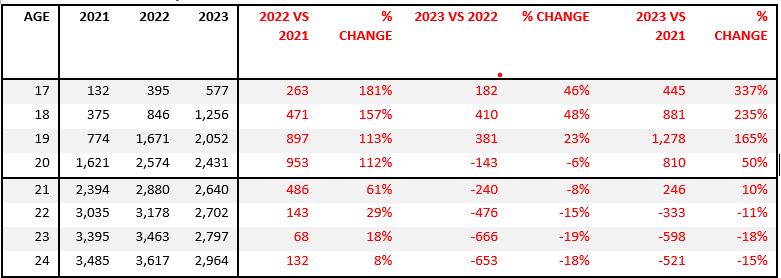

Data gathered through a Freedom of Information (FOI) request to the DVLA reveals that in 2021, there were 2,902 IN10 endorsements added to licence holders of this age grouping. This increased to 5,486 in 2022 and reached 6,316 for 2023 (+118% vs 2021). For those aged 21-24, the picture is more mixed. While IN10 endorsements rose from 12,309 in 2021 to 13,138 in 2022 (29% increase), they fell to 11,103 in 2023 (a decrease of 8% compared to 2021).

An IN10 endorsement – the code used by the police for ‘using a vehicle uninsured against third party risks on a licence’ - will typically be added to a driver’s licence following an investigation by police forces, either after a camera detects an uninsured vehicle on the road or a driver is stopped by a police officer and reported. IN10s must stay on a driving record for four years from the date of offence. This research relates to the number of new IN10 endorsements added to driver records by age and calendar year.

These hugely concerning endorsement figures coincide with a period of rapidly rising annual car insurance premiums with drivers of all ages feeling the pinch. Average annual premiums increased by a quarter (25%) between 2022 and 2023**. Thankfully, more recent indicators suggest motor insurance costs for 2024 appear to be topping out** from the eye-watering increases of the past 18 months.

Additional research conducted by IAM RoadSmart*** of 2,437 members in February 2024 reveals that almost half (49%) say their most recent car insurance renewal price is ‘significantly more expensive’ compared to the previous year. More than two-thirds (69%) of members now identify the cost of insurance as the biggest challenge for young drivers. A pragmatic 60% of members believe a young driver advanced qualification should be recognised by insurers as a method to reduce costs while improving driving standards.

Given these findings, IAM RoadSmart is today warning of an uninsured driver epidemic which threatens to spiral out of control unless action is taken by the UK Government. Today we launch three calls to action as part of our campaign to help young drivers:

- The Treasury should halve the current standard 12% rate of insurance premium tax (IPT) on motoring policies of those aged under 25 to 6%.

- The Treasury should zero-rate IPT on policies where licence holders under the age of 25 have completed an ‘approved driving or riding course’ which would encourage take-up of a skills-based assessment.

- Update the current UK Government road safety strategy with a focus on skills development and training (including a form of graduated driver licensing) and create a Young Drivers Taskforce within the Department for Transport which focuses on issues specifically impacting younger drivers.

Driving a vehicle without insurance will result in a £300 fixed penalty and six points on a licence. However, should the case go to court, punishments could be more severe including an unlimited fine. Even if the vehicle itself is insured, drivers can still be punished without the correct insurance policy to drive it and police may even invoke section 165 of the 1988 Road Traffic Act**** giving them powers to seize an uninsured vehicle. Rising numbers of uninsured drivers often leads to an increase in everyone’s premiums because those involved in a collision with an uninsured driver will need to claim from the Motor Insurers' Bureau (MIB) which levies any company that underwrites motor insurance premiums.

IAM RoadSmart Director of Policy and Standards Nicholas Lyes said:

“It is legal requirement to have the correct insurance to drive, so it is deeply concerning to see a surge in young drivers breaking the law in this way. Unless there is intervention, we risk an epidemic of uninsured younger motorists taking to the roads.

“Sadly, this is likely a consequence of the soaring costs of insurance premiums over the last 18 months. For young drivers who have recently passed their test, the cost of learning to drive, getting a vehicle, taxing it and then insuring it is becoming an extremely costly process. While the insurance sector believes we may now be over the worst of price increases, falling premiums will feel like a lifetime away for newly qualified drivers. Perversely, young drivers are also disproportionately paying more tax when insuring their vehicle because insurance premium tax is levied at a standard 12% rate on already costlier premiums, meaning something of a windfall for the Treasury.

“This is why we are launching a three-point action plan for Government to give young motorists some respite. Moreover, it’s time the Government, the road safety sector and the insurance industry got around the table to thrash out some longer-term solutions which should include a form of graduated driver licensing. Making sure we upskill young drivers of today will ensure we have better drivers for tomorrow.”

ENDS

Notes to editors:

Table 1: The table below gives the number of IN10 endorsements added to driver records, broken down by the age of the driver and calendar year

*** ABI data https://www.abi.org.uk/news/news-articles/2024/4/motor-premiums-stabilise-but-cost-to-insurers-mount/

*** IAM RoadSmart survey conducted by Online95 to our members panel in February 2024 – data tables available on request

**** https://www.legislation.gov.uk/ukpga/1988/52/section/165A

Press contacts:

Press office – +44 (0) 20 8996 9777 – press.office@iam.org.uk

Nicholas Lyes, Director of Policy and Standards, IAM Roadsmart

Rebecca Dundon, Press officer, IAM RoadSmart

Follow us:

On Facebook: www.facebook.com/IAMRoadSmart

On X (formerly Twitter): @IAMRoadSmart

Media centre: https://media.iamroadsmart.com/

About IAM RoadSmart

IAM RoadSmart is the UK’s largest road safety charity. It has a vision of a society where all road users can safely and sustainably use the public highways together. It does this through a range of means including through the advanced driving and riding tests. IAM RoadSmart was formed in March 1956 and has around 75,000 members that supports its campaigns on road safety. At any one time there are over 7,000 drivers and riders actively engaged with IAM RoadSmart’s courses.

To find out more about IAM RoadSmart products and services visit: www.iamroadsmart.com

ENDS ALL

Topics

Categories

Regions

About IAM RoadSmart

IAM RoadSmart is the UK’s largest road safety charity. It has a vision of a society where all road users can safely and sustainably use the public highways together. It does this through a range of means including through the advanced driving and riding tests. IAM RoadSmart was formed in March 1956 and has over 75,000 members that supports its campaigns on road safety. At any one time there are over 7,000 drivers and riders actively engaged with IAM RoadSmart’s courses.

To find out more about IAM RoadSmart products and services visit: www.iamroadsmart.com